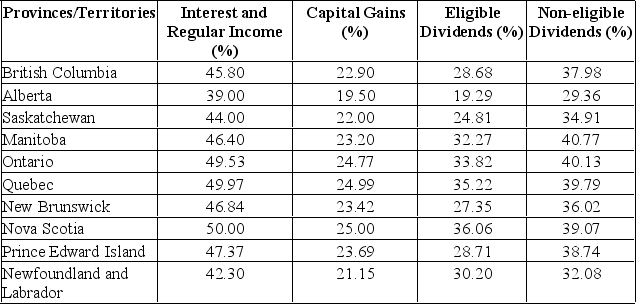

Calculate the tax difference between a British Columbia resident and an Alberta resident both having $20,000 in interest income and $25,000 in capital gains.

A) British Columbia resident would pay $2,210.00 more than the Alberta resident.

B) British Columbia resident would pay $2,210.00 less than the Alberta resident.

C) British Columbia resident would pay $3,500.00 more than the Alberta resident.

D) British Columbia resident would pay $3,500.00 less than the Alberta resident.

E) There are no tax differences between the two tax payers.

Correct Answer:

Verified

Q249: Which one of the following is a

Q250: Under GAAP, statement of financial position, assets

Q251: Cash flow from assets is equal to

Q252: Calculate the tax difference between a

Q253: Cash flow to shareholders is best described

Q255: Cash flow to creditors is best described

Q256: The ease and speed with which an

Q257: _ normally must be paid by a

Q258: Calculate the tax difference between a

Q259: Which of the following does NOT directly

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents