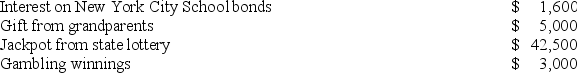

Polly Nolan received the following items this year.  Compute Polly's gross income.

Compute Polly's gross income.

A) $47,100

B) $42,500

C) $45,500

D) $47,500

Correct Answer:

Verified

Q1: A charitable contribution in excess of the

Q21: An activity will be classified as a

Q22: A taxpayer must purchase a new personal

Q25: Real estate taxes deducted for regular tax

Q29: Which of the following items is included

Q31: William took out a $440,000 mortgage to

Q33: The federal income tax system provides incentives

Q34: Any gain recognized on the sale of

Q38: A taxpayer must have owned and lived

Q39: A thief broke into Kate's condominium and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents