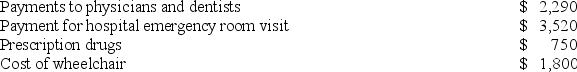

Mr.and Mrs.Oliva incurred the following unreimbursed medical expenses this year.  If the Olivas' AGI is $43,100,compute their medical expense deduction.

If the Olivas' AGI is $43,100,compute their medical expense deduction.

A) $0

B) $90

C) $6,200

D) $4,050

Correct Answer:

Verified

Q44: Mr. Haugh owns a sporting goods store

Q50: Ms. Bjorn contributed $600,000 cash to qualified

Q51: Three years ago, Suzanne bought a new

Q52: Spencer paid the following taxes this year.

Q55: Which of the following government transfer payments

Q57: Which of the following donations doesn't qualify

Q58: Ted and Alice divorced in 2014.Pursuant to

Q58: Which of the following statements about divorce

Q60: Six years ago,Milo Lenz,an amateur artist,sculpted a

Q61: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents