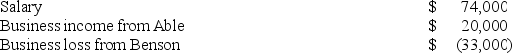

Mr.Vernon owns stock in two S corporations,Able Corporation and Benson Inc.This year,Mr.Vernon had the following income and loss items.  If Vernon materially participates in Able's business but not in Benson's business,compute his AGI.

If Vernon materially participates in Able's business but not in Benson's business,compute his AGI.

A) $94,000

B) $74,000

C) $61,000

D) $41,000

Correct Answer:

Verified

Q69: Which of the following statements about investment

Q73: Which of the following statements about an

Q79: In 2017,Mrs.Owens paid $50,000 for 3,000 shares

Q82: Ms.Cowler owns stock in Serzo Inc.,an S

Q83: Lindsey owns and actively manages an apartment

Q85: Ms. Adair, a single individual, has $218,000

Q89: Mr.and Mrs.Bolt's joint return reports $267,500 AGI,which

Q98: Which of the following statements about the

Q99: Mr. Lee made the following transfers this

Q100: Mr. and Mrs. Sturm actively manage an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents