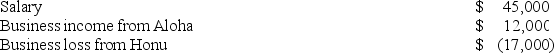

Ms.Mollani owns stock in two S corporations,Aloha and Honu.This year,she had the following income and loss items:

Compute Ms.Mollani's AGI under each of the following assumptions.

Compute Ms.Mollani's AGI under each of the following assumptions.

a.She materially participates in Aloha's business but not in Honu's business.

b.She materially participates in Honu's business but not in Aloha's business.

c.She materially participates in both corporate businesses.

d.She does not materially participate in either business.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Mr. Lainson died this year on a

Q82: Mr. and Mrs. Gupta want to make

Q83: Mrs. Heyer inherited real estate from her

Q96: Ms.Watts owns stock in two S corporations,MKP

Q97: This year,Mr.and Mrs.Lebold paid $3,100 investment interest

Q98: Mr.and Mrs.Nelson operate a small business as

Q99: Last year,Mr.Margot purchased a limited interest in

Q102: In 2019,Mr.Ames,an unmarried individual,made a gift of

Q103: Mr.McCann died this year.During his lifetime,he made

Q105: Mr.Carp,a single taxpayer,recognized a $44,000 long-term capital

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents