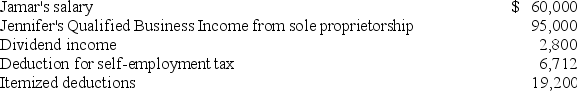

Jennifer and Jamar are married and live in a home with their 13-year-old dependent son,Oscar.This year,they had the following tax information.  Compute adjusted gross income (AGI) and taxable income.

Compute adjusted gross income (AGI) and taxable income.

A) AGI $157,800; taxable income $124,188.

B) AGI $157,800; taxable income $130,900.

C) AGI $151,088; taxable income $89,888.

D) AGI $151,088; taxable income $107,888.

Correct Answer:

Verified

Q65: Which of the following statements describing individual

Q68: Which of the following statements is false?

A)

Q71: In determining the standard deduction, which of

Q75: Which of the following statements describing individual

Q77: Which of the following statements regarding a

Q78: Meraleigh, age 16, is claimed as a

Q79: Mr.and Mrs.Anderson file a joint return.They provide

Q80: Which of the following statements regarding the

Q81: Ruth Anne,a single taxpayer,reported $529,500 alternative minimum

Q92: Mr. and Mrs. Harvey's tax liability before

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents