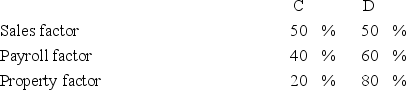

Albany,Inc.does business in states C and D.State C uses an apportionment formula that double-weights the sales factor; state D apportions income using an equally-weighted three-factor formula.Albany's before tax income is $3,000,000,and its sales,payroll,and property factors are as follows.  Calculate Albany's income taxable in each state.

Calculate Albany's income taxable in each state.

A) State C,$1,100,000; State D,$1,800,000.

B) State C,$1,100,000; State D,$1,900,000.

C) State C,$1,200,000; State D,$1,800,000.

D) State C,$1,200,000; State D,$1,900,000.

Correct Answer:

Verified

Q67: Pennworth Corporation operates in the United States

Q68: World Sales,Inc.,a U.S.multinational,had pretax U.S.source income and

Q68: Which of the following statements concerning the

Q70: Fleming Corporation,a U.S.multinational,has pretax U.S.source income and

Q72: Which of the following statements about the

Q73: Which of the following would qualify as

Q74: Global Corporation,a U.S.multinational,began operations this year.Global had

Q76: Many Mountains,Inc.is a U.S.multinational corporation.This year,it had

Q77: Cambridge,Inc.conducts business in states X and Y.This

Q78: Southern, an Alabama corporation, has a $7

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents