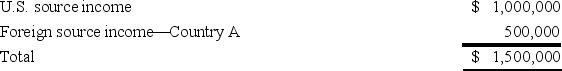

Fleming Corporation,a U.S.multinational,has pretax U.S.source income and foreign source income as follows:  Fleming paid $200,000 income tax to Country A.If Fleming takes the foreign tax credit,compute its worldwide tax burden as a percentage of its pretax income.

Fleming paid $200,000 income tax to Country A.If Fleming takes the foreign tax credit,compute its worldwide tax burden as a percentage of its pretax income.

A) 21%

B) 17.33%

C) 34.33%

D) 35%

Correct Answer:

Verified

Q66: San Carlos Corporation,a U.S.multinational,had pretax U.S.source income

Q67: Pennworth Corporation operates in the United States

Q68: World Sales,Inc.,a U.S.multinational,had pretax U.S.source income and

Q68: Which of the following statements concerning the

Q72: Which of the following statements about the

Q72: Albany,Inc.does business in states C and D.State

Q73: Which of the following would qualify as

Q74: Global Corporation,a U.S.multinational,began operations this year.Global had

Q75: Which of the following taxes is eligible

Q78: Southern, an Alabama corporation, has a $7

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents