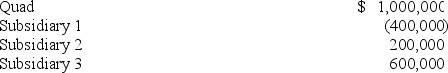

The Quad affiliated group consists of Quad,a Delaware corporation,and its three wholly-owned subsidiaries.This year,the four corporations report the following net income (loss) .  If Quad elects to file a consolidated U.S.tax return,compute consolidated taxable income assuming that subsidiaries 1 and 2 are domestic corporations and subsidiary 3 is a foreign corporation.

If Quad elects to file a consolidated U.S.tax return,compute consolidated taxable income assuming that subsidiaries 1 and 2 are domestic corporations and subsidiary 3 is a foreign corporation.

A) $1,000,000

B) $800,000

C) $1,400,000

D) $1,800,000

Correct Answer:

Verified

Q67: Which of the following statements about organizational

Q80: Fleming Corporation,a U.S.multinational,has pretax U.S.source income and

Q80: Which of the following statements about income

Q82: Lincoln Corporation,a U.S.corporation,owns 50% of the stock

Q83: Orchid Inc.,a U.S.multinational with a 21% marginal

Q86: Cheney is a controlled foreign corporation with

Q87: Frost Inc., a calendar year U.S. corporation,

Q87: Galaxy Corporation conducts business in the U.S.and

Q88: Lincoln Corporation,a U.S.corporation,owns 50% of the stock

Q99: Macon, Inc., a U.S. corporation, owns stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents