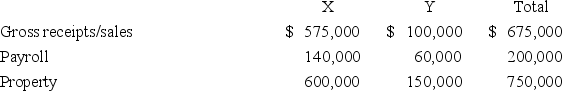

Origami does business in states X and Y.State X uses an equally-weighted three-factor apportionment formula and has a 4 percent state tax rate.State Y uses an apportionment formula that double-weights the sales factor and has a 6 percent tax rate.Origami's taxable income,before apportionment,is $3 million.Its sales,payroll,and property information are as follows.

a.Calculate Origami's apportionment factors,income apportioned to each state,and state tax liability.

a.Calculate Origami's apportionment factors,income apportioned to each state,and state tax liability.

b.State Y is considering changing its apportionment formula to a single sales factor.Given its current level of activity,would such a change increase or decrease Origami's state income tax burden? Provide calculations to support your conclusion.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Berger is a controlled foreign corporation with

Q93: Wilmington, Inc., a Pennsylvania corporation, manufactures computer

Q97: Which of the following statements regarding Internal

Q101: Koscil Inc.had the following taxable income.

Q103: This year,Plateau,Inc.'s before-tax income was $4,765,000.Plateau paid

Q105: Crane,Inc.is a domestic corporation with several foreign

Q106: Kraze,Inc.,a calendar year domestic corporation,owns 50 percent

Q106: DFJ, a Missouri corporation, owns 55% of

Q107: Pogo,Inc.,which has a 21 percent marginal tax

Q111: Transfer pricing issues arise:

A)When tangible goods are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents