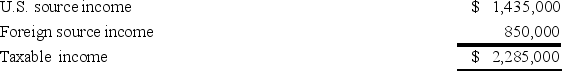

Koscil Inc.had the following taxable income.

Koscil paid $315,000 foreign income tax.Compute its U.S.income tax liability.

Koscil paid $315,000 foreign income tax.Compute its U.S.income tax liability.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q76: Which of the following entities is not

Q84: Chester, Inc., a U.S. multinational, earned $4

Q85: Fallon Inc., a U.S. corporation, owns stock

Q93: Wilmington, Inc., a Pennsylvania corporation, manufactures computer

Q96: Which of the following statements regarding controlled

Q96: If a U.S.multinational corporation incurs start-up losses

Q103: This year,Plateau,Inc.'s before-tax income was $4,765,000.Plateau paid

Q105: Crane,Inc.is a domestic corporation with several foreign

Q106: DFJ, a Missouri corporation, owns 55% of

Q106: Kraze,Inc.,a calendar year domestic corporation,owns 50 percent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents