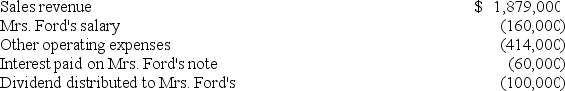

Mrs.Ford,who has a 37% marginal tax rate,is the sole shareholder and CEO of Fast Inc.She also holds a $1 million interest-bearing note issued by Fast.The corporation's current-year financial records show the following:  Compute Fast's taxable income.

Compute Fast's taxable income.

A) $1,145,000

B) $1,245,000

C) $1,305,000

D) $1,465,000

Correct Answer:

Verified

Q50: Homer currently operates a successful S corporation.

Q63: Gerry is the sole shareholder and president

Q64: The IRS agent who audited the Form

Q68: Cathy is the President and sole shareholder

Q78: Mrs. Jansen is the sole shareholder of

Q83: Which of the following statements regarding the

Q84: During a recent IRS audit,the revenue agent

Q85: Mr. Olsen has a marginal tax rate

Q86: Which of the following benefits does not

Q94: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents