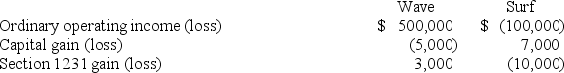

Wave Corporation owns 90% of the stock of Surf,Inc.Each corporation reports the following separate items for the current tax year:  Compute consolidated taxable income if Wave and Surf file a consolidated federal income tax return:

Compute consolidated taxable income if Wave and Surf file a consolidated federal income tax return:

A) $400,000.

B) $395,000.

C) $410,000.

D) $500,000.

Correct Answer:

Verified

Q41: When price competition is fierce, companies easily

Q42: Corporations with less than $1 million of

Q55: Which of the following is a primary

Q56: Fleet,Inc.owns 85% of the stock of Pete,Inc.and

Q57: The only alternative to double taxation of

Q58: Aaron, Inc. is a nonprofit corporation that

Q61: Honu, Inc. has book income of $1,200,000.

Q63: John's, Inc. manufactures and sells fine furniture.

Q64: Airfreight Corporation has book income of $370,000.

Q69: Slipper Corporation has book income of $500,000.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents