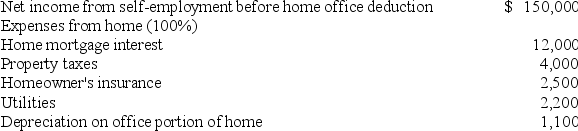

Aaron James has a qualifying home office.The office is 500 square feet and the entire house is 2,500 square feet.Use the following information to determine his allowable home office deduction:

A) $5,240

B) $4,140

C) $4,260

D) $21,800

Correct Answer:

Verified

Q24: John's share of partnership loss was $60,000.

Q27: If a business is formed as an

Q30: A partner's tax basis in his or

Q32: Corporations cannot be shareholders in an S

Q34: Randolph Scott operates a business as a

Q36: Carter's share of a partnership's operating loss

Q41: Waters Corporation is an S corporation with

Q42: Sue's 2019 net (take-home)pay was $23,205.Her only

Q42: Which of the following amounts are not

Q44: Which of the following statements regarding a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents