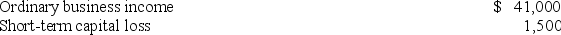

Alex is a partner in a calendar year partnership.His partnership Schedule K-1 for the current tax year showed the following:  Alex has a $7,000 loss carryforward from the partnership last year,which he could not deduct because of the basis limitation.What is his tax basis in his partnership interest at the end of the current tax year?

Alex has a $7,000 loss carryforward from the partnership last year,which he could not deduct because of the basis limitation.What is his tax basis in his partnership interest at the end of the current tax year?

A) $41,000

B) $32,500

C) $39,500

D) $34,000

Correct Answer:

Verified

Q44: Martha Pim is a general partner in

Q64: Which of the following statements regarding a

Q64: Bernard and Leon formed a partnership on

Q65: Waters Corporation is an S corporation with

Q65: Max is a 10% limited partner in

Q68: Mutt and Jeff are general partners in

Q68: Which of the following statements regarding the

Q69: George and Martha formed a partnership by

Q71: Which of the following items would be

Q72: Gavin owns a 50% interest in London

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents