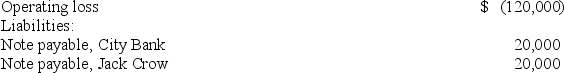

Orange,Inc.is a calendar year partnership with the following current year information:  On January 1,John James bought 50% general interest in Orange,Inc.for $30,000.How much of the operating loss may John deduct on his Form 1040? Assume the excess business loss limitation does not apply.

On January 1,John James bought 50% general interest in Orange,Inc.for $30,000.How much of the operating loss may John deduct on his Form 1040? Assume the excess business loss limitation does not apply.

A) $60,000

B) $30,000

C) $40,000

D) $50,000

Correct Answer:

Verified

Q44: Martha Pim is a general partner in

Q45: Which of the following statements about partnerships

Q46: Kelly operates a sole proprietorship with qualified

Q57: Waters Corporation is an S corporation with

Q59: Janice earned $175,000 of qualified business income

Q59: Debbie is a limited partner in ADK

Q64: Bernard and Leon formed a partnership on

Q64: Which of the following statements regarding a

Q65: Max is a 10% limited partner in

Q65: Waters Corporation is an S corporation with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents