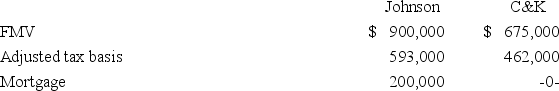

Johnson Inc.and C&K Company entered into an exchange of real property.Here is the information for the properties to be exchanged.  Pursuant to the exchange,C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property.Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

Pursuant to the exchange,C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property.Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

A) $200,000 gain recognized; $662,000 basis in Johnson property.

B) No gain recognized; $462,000 basis in Johnson property.

C) No gain recognized; $487,000 basis in Johnson property.

D) None of the choices are correct.

Correct Answer:

Verified

Q47: Teco Inc. and MW Company exchanged like-kind

Q55: Nixon Inc. transferred Asset A to an

Q56: Tauber Inc. and J&I Company exchanged like-kind

Q57: Rydell Company exchanged business realty (initial cost

Q58: G&G Inc.transferred an old asset with a

Q60: LiO Company transferred an old asset with

Q64: Perry Inc.and Dally Company entered into an

Q67: Johnson Inc.and C&K Company entered into an

Q68: A fire destroyed furniture and fixtures used

Q78: Carman wishes to exchange 10 acres of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents