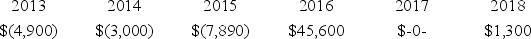

Irby Inc.was incorporated in 2013 and adopted a calendar year.Here is a schedule of Irby's net Section 1231 gains and (losses) reported on its tax returns through 2018.  In 2019,Irby recognized a $14,750 gain on the sale of business land.How is this gain characterized on Irby's tax return?

In 2019,Irby recognized a $14,750 gain on the sale of business land.How is this gain characterized on Irby's tax return?

A) $14,750 Section 1231 gain.

B) $10,890 ordinary gain and $9,415 Section 1231 gain.

C) $14,750 ordinary gain.

D) None of the choices are correct.

Correct Answer:

Verified

Q80: Mr.Quick sold marketable securities with a $112,900

Q81: Firm F purchased a commercial office building

Q82: Delour Inc.was incorporated in 2013 and adopted

Q84: Proctor Inc.was incorporated in 2013 and adopted

Q86: Which of the following assets is not

Q87: Benlow Company,a calendar year taxpayer,sold two operating

Q88: Mr.and Mrs.Marley operate a small business.This year,the

Q89: This year,Izard Company sold equipment purchased several

Q90: Zeron Inc. generated $1,349,600 ordinary income from

Q95: Lettuca Inc. generated a $77,050 ordinary loss

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents