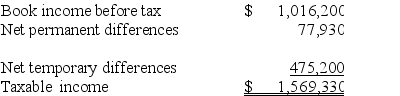

Goff Inc.'s taxable income is computed as follows:  Goff's tax rate is 21%.Which of the following statements is true?

Goff's tax rate is 21%.Which of the following statements is true?

A) The permanent differences caused a $16,365 net increase in Goff's deferred tax liabilities.

B) The permanent differences caused a $16,365 net increase in Goff's deferred tax assets.

C) The temporary differences caused a $99,792 net increase in Goff's deferred tax assets.

D) The temporary differences caused a $99,792 net increase in Goff's deferred tax liabilities.

Correct Answer:

Verified

Q61: Tax expense per books is based on:

A)

Q65: B&B Inc.'s taxable income is computed as

Q68: B&B Inc.'s taxable income is computed as

Q68: According to your textbook, business managers prefer

Q70: Which of the following businesses is prohibited

Q71: Which of the following statements about the

Q72: Which of the following statements about the

Q73: Eaton Inc.is a calendar year,cash basis taxpayer.On

Q74: Addis Company operates a large retail men's

Q80: Which of the following statements describes a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents