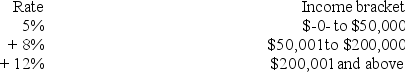

Jurisdiction M imposes an individual income tax based on the following schedule.  Which of the following statements is true?

Which of the following statements is true?

A) The schedule provides no information as to whether Jurisdiction M's tax is horizontally equitable.

B) Jurisdiction M's tax is vertically equitable.

C) Jurisdiction M's tax is vertically equitable only for individuals with $50,000 or less taxable income.

D) Both "The schedule provides no information as to whether Jurisdiction M's tax is horizontally equitable" and "Jurisdiction M's tax is vertically equitable" are true.

Correct Answer:

Verified

Q22: Government J decides that it must increase

Q33: The city of Belleview operated at an

Q37: The U.S. individual income tax has always

Q38: The government of Nation C operated at

Q41: Which of the following statements does not

Q43: The sales tax laws of many states

Q44: The statement that "an old tax is

Q45: Which of the following statements about the

Q56: The federal income tax law allows individuals

Q58: Which of the following statements regarding a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents