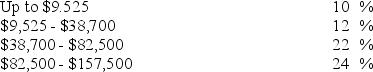

Al Barkley is single and earns $40,000 in taxable income.He uses the following tax rate schedule to calculate the taxes he owes.  What is Al's average tax rate?

What is Al's average tax rate?

A) 11.85%

B) 18.27%

C) 21.35%

D) 23.87%

E) 25.00%

Correct Answer:

Verified

Q61: Alex Bates goes on The Price Is

Q62: The state of Oklahoma imposes a tax

Q63: Elizabeth Gleason just died.At the time of

Q64: Which one of these statements correctly applies

Q65: An itemized deduction of $800 with a

Q67: Joan Sanchez is single and earns $40,000

Q68: Haley Thomas has adjusted gross income of

Q69: Which one of the following is a

Q70: Kim Lee is single and earns $32,000

Q71: Elaine's Embroidery Emporium which is run out

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents