Comparative Financial Statements for Tomtric Company Follow Additional Data on Activities During 2019 Are as Follows:

•

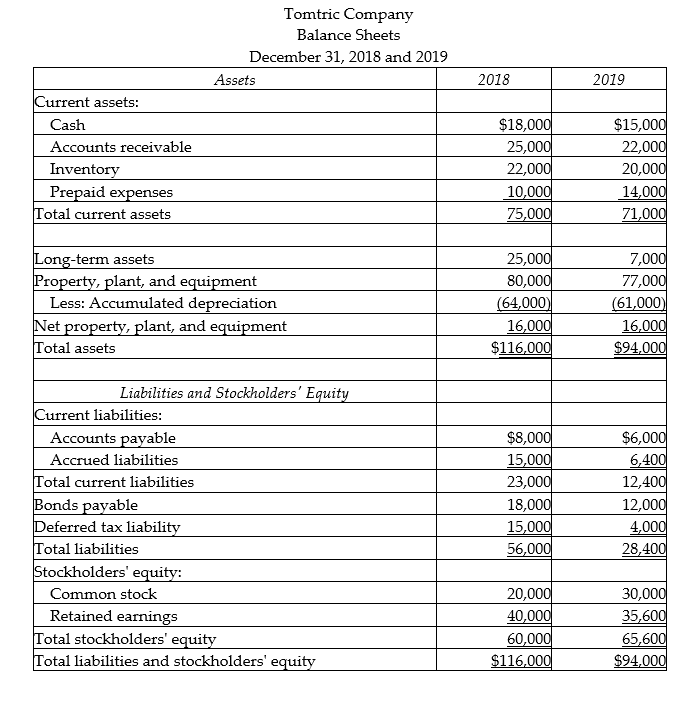

Comparative financial statements for Tomtric Company follow:

Additional data on activities during 2019 are as follows:

• During 2019, Tomtric Company sold used equipment for $3,000 that had cost $15,000 with accumulated depreciation of $8,000.

• New equipment was purchased for $12,000 cash.

• Cash dividends totaling $8,000 were paid.

• Long-term investments that had cost $18,000 when purchased were sold for $18,000.

• Common stock was issued for $10,000.

Required:

Prepare the financing activities section of the statement of cash flows.

Correct Answer:

Verified

Sale of ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q91: Svengool Inc. financial statements included the

Q92: On the statement of cash flows, cash

Q93: Which of the following items would not

Q94: Under the direct method, bad debt expense

Q95: When preparing the financing activities section of

Q97: What types of accounts are typically affected

Q98: Which of the following items would be

Q99: Bad debt expense and share-based compensation expense

Q100: PipCo financial statements included the following

Q101: In 2019, BayKing Company sold used equipment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents