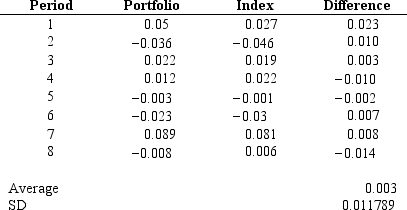

The table below provides returns on a portfolio along with returns for the corresponding benchmark index for the past eight quarters. The table also provides the difference between portfolio returns and the benchmark index, the average of these differences over the past eight quarters and the standard deviation of these differences.  The annualized tracking error for this period is

The annualized tracking error for this period is

A) 2.36%

B) 4.08%

C) 2.89%

D) 3.33%

E) 1.18%

Correct Answer:

Verified

Q24: Which of the following is not considered

Q36: In _ strategy,certain economic sectors or industries

Q46: Which of the following statements regarding 130/30

Q49: A portfolio manager who is trying to

Q51: Fund XYZ had a pretax return of

Q53: If the annual geometric mean for the

Q54: The goal of the passive portfolio manager

Q55: A contrarian investment strategy is based on

Q57: In returns-based style analysis a coefficient of

Q60: A Long futures positions in the S&P500

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents