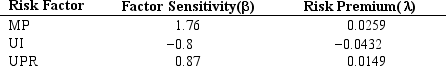

The table below provides factor risk sensitivities and factor risk premia for a three factor model for a particular asset where factor 1 is MP the growth rate in U.S. industrial production, factor 2 is UI the difference between actual and expected inflation, and factor 3 is UPR the unanticipated change in bond credit spread.  Calculate the expected excess return for the asset.

Calculate the expected excess return for the asset.

A) 12.32%

B) 9.32%

C) 4.56%

D) 6.32%

E) 8.02%

Correct Answer:

Verified

Q27: Unlike the capital asset pricing model,the arbitrage

Q35: Dhrymes,Friend,and Gultekin,in their study of the APT,found

Q37: One approach for using multifactor models is

Q37: Consider the following list of risk factors:

Q41: Exhibit 9.3

Use the Information Below for

Q46: Under the following conditions, what are the

Q49: Exhibit 9.2

Use the Information Below for

Q52: Exhibit 9.2

USE THE INFORMATION BELOW FOR

Q55: Exhibit 9.2

Use the Information Below for

Q56: Exhibit 9.3

Use the Information Below for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents