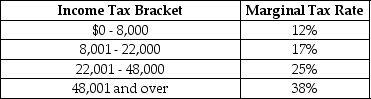

Table 18-6

Table 18-6 shows the income tax brackets and tax rates for single taxpayers in Calpernia.

Table 18-6 shows the income tax brackets and tax rates for single taxpayers in Calpernia.

-Refer to Table 18-6. How much income tax does Sasha pay if she is a single taxpayer with an income of $60,000?

A) $22,800

B) $14,400

C) $13,800

D) $13,642

Correct Answer:

Verified

Q62: If you pay $2,000 in taxes on

Q63: If you pay a constant percentage of

Q68: If, as your taxable income decreases, you

Q83: A tax bracket is

A)the percent of taxable

Q84: The "ability-to-pay" principle of taxation is the

Q89: If the marginal tax rate is equal

Q90: Policymakers focus on marginal tax rate changes

Q91: All of the following occur whenever a

Q94: Gasoline taxes that are typically used for

Q97: A marginal tax rate is

A)the fraction of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents