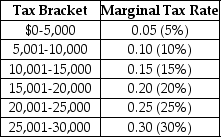

Last year, Anthony Millanti earned exactly $30,000 of taxable income. Assume that the income tax system used to determine Anthony's tax liability is progressive. The table below lists the tax brackets and the marginal tax rates that apply to each bracket.

a. Draw a new table that lists the amounts of income tax that Anthony is obligated to pay for each tax bracket, and the total tax he owes the government. (Assume that there are no allowable tax deductions, tax credits, personal exemptions, or any other deductions that Anthony can use to reduce his tax liability).

b. Determine Anthony's average tax rate.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q143: According to the benefits-received principle, those who

Q150: If you pay $3,000 in taxes on

Q153: If you pay $14,000 in taxes on

Q155: In 2016, which type of tax raised

Q157: Table 18-10 Q162: Figure 18-2 Q163: Figure 18-2 Q164: Figure 18-2 Q176: The term tax incidence refers to Q180: Figure 18-1 Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents

![]()

![]()

![]()

![]()

A)the degree

![]()