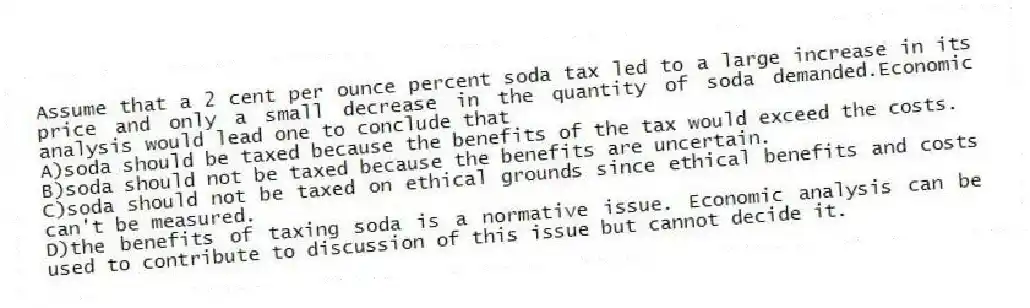

Assume that a 2 cent per ounce percent soda tax led to a large increase in its price and only a small decrease in the quantity of soda demanded.Economic analysis would lead one to conclude that

A) soda should be taxed because the benefits of the tax would exceed the costs.

B) soda should not be taxed because the benefits are uncertain.

C) soda should not be taxed on ethical grounds since ethical benefits and costs can't be measured.

D) the benefits of taxing soda is a normative issue. Economic analysis can be used to contribute to discussion of this issue but cannot decide it.

Correct Answer:

Verified

Q227: The demand for most farm products is

Q228: If a soda tax is implemented and

Q229: Explain the concepts of cross-price elasticity of

Q230: The paradox of American farming is

A)the demand

Q231: Suppose a frost destroys the tomato crop

Q233: The price of wheat has fallen since

Q234: A soda tax is more effective at

Q235: When the price of Starbucks coffee increased

Q236: A recent study indicated that "Stricter college

Q237: Since 1950, there has been a substantial

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents