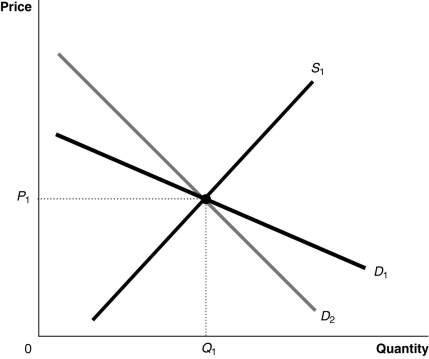

Figure 4-17

-Refer to Figure 4-17. Suppose the market is initially in equilibrium at price P1 and then the government imposes a tax on every unit sold. Which of the following statements best describes the impact of the tax?

A) The consumer will bear a smaller share of the tax burden if the demand curve is D1.

B) The consumer's share of the tax burden is the same whether the demand curve is D1 or D2.

C) The consumer will bear a smaller share of the tax burden if the demand curve is D2.

D) The consumer will bear the entire burden of the tax if the demand curve is D2 and the producer will bear the entire burden of the tax if the demand curve is D1.

Correct Answer:

Verified

Q147: Price floors are illegal in the United

Q148: There is a shortage of every good

Q151: Black markets only exist in developing nations.

Q157: The minimum wage is an example of

Q172: Suppose an excise tax of $1 is

Q173: Suppose the demand curve for a product

Q176: The government proposes a tax on imported