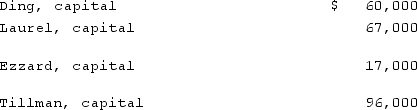

A local partnership was considering the possibility of liquidation. Capital account balances at that time were as follows. Profits and losses were divided on a 4:2:2:2 basis, respectively.  At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time.If the assets could be sold for $228,000 and there are no liquidation expenses, what is the amount that Laurel would receive from the liquidation?

At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time.If the assets could be sold for $228,000 and there are no liquidation expenses, what is the amount that Laurel would receive from the liquidation?

A) $36,000.

B) $0.

C) $2,500.

D) $38,250.

E) $67,250.

Correct Answer:

Verified

Q10: The Allen, Bevell, and Carter partnership began

Q11: A local partnership was in the process

Q12: The Keller, Long, and Mason partnership had

Q13: A local partnership was considering the possibility

Q14: The Henry, Isaac, and Jacobs partnership was

Q16: The Allen, Bevell, and Carter partnership began

Q17: The Keller, Long, and Mason partnership had

Q18: The Henry, Isaac, and Jacobs partnership was

Q19: A local partnership was considering the possibility

Q20: The Keller, Long, and Mason partnership had

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents