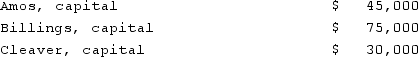

The Amos, Billings, and Cleaver partnership had two assets: (1) cash of $40,000 and (2) an investment with a book value of $110,000. The ratio for sharing profits and losses is 2:1:1. The balances in the capital accounts were:  Required:If the investment was sold for $80,000, how much cash would each partner receive upon liquidation?

Required:If the investment was sold for $80,000, how much cash would each partner receive upon liquidation?

Correct Answer:

Verified

Q40: A local partnership has assets of cash

Q41: As of January 1, 2021, the partnership

Q42: A partnership had the following account balances:

Q43: On January 1, 2021, the partners of

Q44: The balance sheet of Rogers, Dennis &

Q46: The balance sheet of Rogers, Dennis &

Q47: The partners of Donald, Chief & Berry

Q48: Jones, Marge, and Tate LLP decided to

Q49: As of January 1, 2021, the partnership

Q50: The balance sheet of Rogers, Dennis &

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents