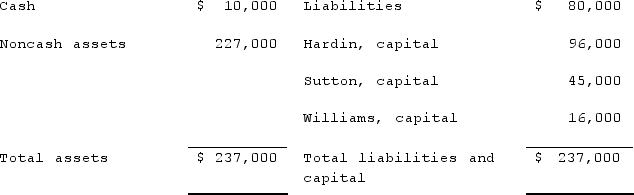

Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.The following balance sheet has been produced:  During the liquidation process, the following transactions take place:- Noncash assets are sold for $116,000.- Liquidation expenses of $12,000 are paid. No further expenses are expected.- Safe capital distributions are made to the partners.- Payment is made of all business liabilities.- Any deficit capital account balances are deemed to be uncollectible.Prepare journal entries to record the actual liquidation transactions.

During the liquidation process, the following transactions take place:- Noncash assets are sold for $116,000.- Liquidation expenses of $12,000 are paid. No further expenses are expected.- Safe capital distributions are made to the partners.- Payment is made of all business liabilities.- Any deficit capital account balances are deemed to be uncollectible.Prepare journal entries to record the actual liquidation transactions.

Correct Answer:

Verified

Q46: The balance sheet of Rogers, Dennis &

Q47: The partners of Donald, Chief & Berry

Q48: Jones, Marge, and Tate LLP decided to

Q49: As of January 1, 2021, the partnership

Q50: The balance sheet of Rogers, Dennis &

Q52: A partnership held three assets: Cash, $13,000;

Q53: On January 1, 2021, the partners of

Q54: The balance sheet of Rogers, Dennis &

Q55: On January 1, 2021, the partners of

Q56: Hardin, Sutton, and Williams have operated a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents