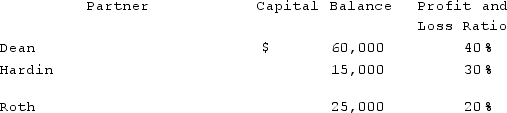

Assume the partnership of Dean, Hardin, and Roth has been in existence for a number of years.Dean decides to withdraw from the partnership when the partners' capital balances are as follows:  An appraisal of the business and its property estimates the fair value to be $ 100,000. Dean has agreed to receive $64,000 in exchange for his partnership interest.Prepare the journal entry for the payment to Dean in the dissolution of his partnership interest, assuming the bonus method is to be applied.

An appraisal of the business and its property estimates the fair value to be $ 100,000. Dean has agreed to receive $64,000 in exchange for his partnership interest.Prepare the journal entry for the payment to Dean in the dissolution of his partnership interest, assuming the bonus method is to be applied.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q75: On January 1, 2021, Lamb and Mona

Q76: Which of the following has most of

Q77: Jipsom and Klark were partners with capital

Q78: Assume the partnership of Howell, Madrid, and

Q79: Assume the partnership of Howell, Madrid, and

Q81: On January 1, 2021, Lamb and Mona

Q82: How is accounting for a partnership different

Q83: What theoretical argument could be made against

Q84: Why are the terms of the Articles

Q85: On January 1, 2021, Lamb and Mona

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents