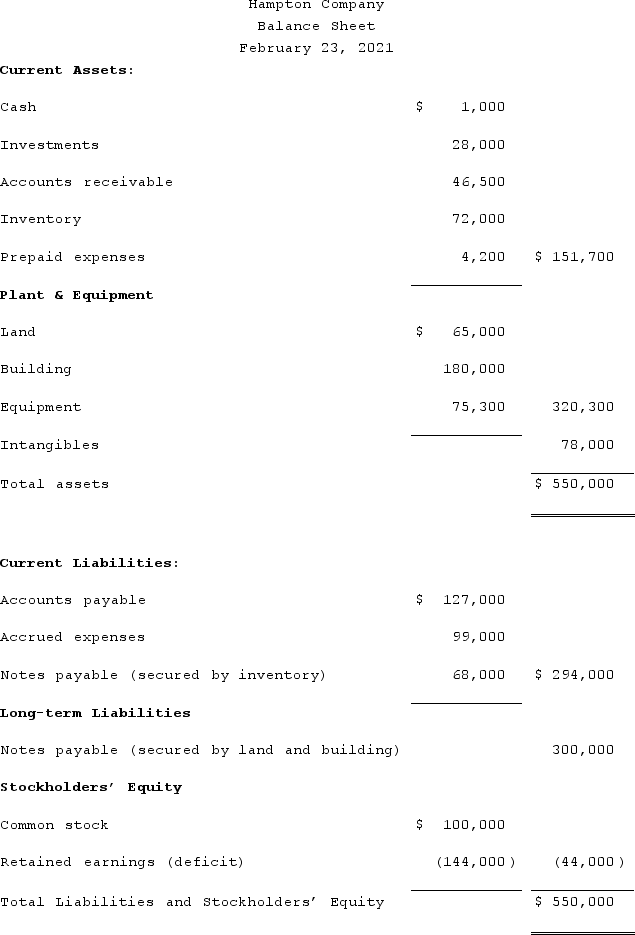

Hampton Company is trying to decide whether to seek liquidation or reorganization. Hampton has provided the following balance sheet:  Additional information is as follows:The investments are currently worth $13,000.It is estimated that $32,000 of the accounts receivable are collectible.The inventory can be sold for $74,000.The prepaid expenses and the intangible assets have no net realizable value.The land and building are currently valued at $250,000.The equipment can be sold for $60,000.Administrative expenses (not yet recorded) are estimated to be $12,500.Accrued expenses include $17,000 of salaries payable ($11,000 to one employee and $3,000 each to two other employees).Accrued expenses include $7,000 of unpaid payroll taxes.How much will be paid to the holder of the note payable secured by the land and building? (Round your payout percentage to the nearest whole number.)

Additional information is as follows:The investments are currently worth $13,000.It is estimated that $32,000 of the accounts receivable are collectible.The inventory can be sold for $74,000.The prepaid expenses and the intangible assets have no net realizable value.The land and building are currently valued at $250,000.The equipment can be sold for $60,000.Administrative expenses (not yet recorded) are estimated to be $12,500.Accrued expenses include $17,000 of salaries payable ($11,000 to one employee and $3,000 each to two other employees).Accrued expenses include $7,000 of unpaid payroll taxes.How much will be paid to the holder of the note payable secured by the land and building? (Round your payout percentage to the nearest whole number.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q72: What is meant by a "partially secured

Q73: What are possible plans that management of

Q74: What is meant by a "fully secured

Q75: What are the four categories of debts

Q76: Hampton Company is trying to decide whether

Q78: Berry Company is going through Chapter 11

Q79: What is the difference between a liquidation

Q80: What term is used for a bankruptcy

Q81: What is the role of the trustee

Q82: How is the presentation of a balance

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents