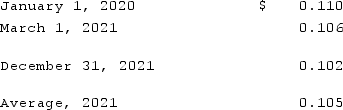

Perez Company, a Mexican subsidiary of a U.S. company, sold equipment costing 200,000 pesos with accumulated depreciation of 75,000 pesos for 140,000 pesos on March 1, 2021. The equipment was purchased on January 1, 2020. Relevant exchange rates for the peso are as follows:  The financial statements for Perez are remeasured by its U.S. parent. What amount of gain or loss would be reported in its translated income statement?

The financial statements for Perez are remeasured by its U.S. parent. What amount of gain or loss would be reported in its translated income statement?

A) $1,530.

B) $1,575.

C) $1,590.

D) $1,090.

E) $1,650.

Correct Answer:

Verified

Q54: Esposito is an Italian subsidiary of a

Q55: When preparing a consolidated statement of cash

Q56: Kennedy Company acquired all of the outstanding

Q57: A foreign subsidiary uses the first-in first-out

Q58: Perez Company, a Mexican subsidiary of a

Q60: Esposito is an Italian subsidiary of a

Q61: A subsidiary of Reynolds Inc., a U.S.

Q62: Quadros Inc., a Portuguese firm was acquired

Q63: Quadros Inc., a Portuguese firm was acquired

Q64: A subsidiary of Reynolds Inc., a U.S.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents