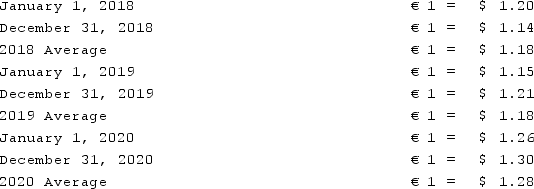

A subsidiary of Reynolds Inc., a U.S. company, was located in a foreign country. The local currency of this subsidiary was the Euro (€) while the functional currency of this subsidiary was the U.S. dollar. The subsidiary acquired Equipment A on January 1, 2018, for €250,000. Depreciation expense associated with Equipment A was €25,000 per year. On January 1, 2020, the subsidiary acquired Equipment B for €150,000 and Equipment B had associated depreciation expense of €10,000. The subsidiary owned no other depreciable assets. Currency exchange rates between the U.S. dollar and the Euro were as follows:  What amount would have been reported for depreciation expense related to the equipment owned by the subsidiary in Reynolds's consolidated balance sheet at December 31, 2020?

What amount would have been reported for depreciation expense related to the equipment owned by the subsidiary in Reynolds's consolidated balance sheet at December 31, 2020?

A) $42,600.

B) $44,800.

C) $45,500.

D) $42,300.

E) $41,500.

Correct Answer:

Verified

Q59: Perez Company, a Mexican subsidiary of a

Q60: Esposito is an Italian subsidiary of a

Q61: A subsidiary of Reynolds Inc., a U.S.

Q62: Quadros Inc., a Portuguese firm was acquired

Q63: Quadros Inc., a Portuguese firm was acquired

Q65: A subsidiary of Reynolds Inc., a U.S.

Q66: Quadros Inc., a Portuguese firm was acquired

Q67: Quadros Inc., a Portuguese firm was acquired

Q68: Quadros Inc., a Portuguese firm was acquired

Q69: Quadros Inc., a Portuguese firm was acquired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents