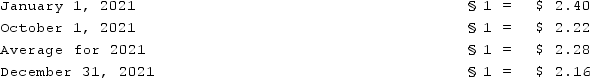

Ginvold Co. began operating a subsidiary in a foreign country on January 1, 2021 by acquiring all of the common stock for §50,000 Stickles, the local currency. This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1, 2022. A building was then purchased for §170,000 on January 1, 2021. This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method. The building was immediately rented for three years to a group of local doctors for §6,000 per month. By year-end, payments totaling §60,000 had been received. On October 1, §5,000 were paid for a repair made on that date and it was the only transaction of this kind for the year. A cash dividend of §6,000 was transferred back to Ginvold on December 31, 2021. The functional currency for the subsidiary was the Stickle (§). Currency exchange rates were as follows:  Prepare a balance sheet for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Prepare a balance sheet for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q87: Boerkian Co. started 2021 with two assets:

Q88: Perkle Co. owned a subsidiary in Belgium;

Q89: What exchange rate should be used to

Q90: What exchange rate would be used to

Q91: A foreign subsidiary of a U.S. corporation

Q93: What is the justification for the remeasurement

Q94: Ginvold Co. began operating a subsidiary in

Q95: What is the basic objective underlying the

Q96: What is the basic assumption underlying the

Q97: Boerkian Co. started 2021 with two assets:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents