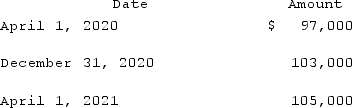

On April 1, 2020, Shannon Company, a U.S. company, borrowed 100,000 euros from a foreign bank by signing an interest-bearing note due April 1, 2021. The dollar value of the loan was as follows:  How much foreign exchange gain or loss should be included in Shannon's 2020 income statement?

How much foreign exchange gain or loss should be included in Shannon's 2020 income statement?

A) $3,000 gain.

B) $3,000 loss.

C) $6,000 gain.

D) $6,000 loss.

E) $7,000 gain.

Correct Answer:

Verified

Q27: U.S. GAAP provides guidance for hedges of

Q28: When a U.S. company purchases parts from

Q29: Which of the following statements is true

Q30: On December 1, 2021, Keenan Company, a

Q31: A U.S. company buys merchandise from a

Q33: All of the following hedges are used

Q34: A U.S. company buys merchandise from a

Q35: Frankfurter Company, a U.S. company, had a

Q36: A U.S. company sells merchandise to a

Q37: A company has a discount on a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents