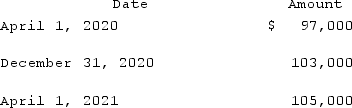

On April 1, 2020, Shannon Company, a U.S. company, borrowed 100,000 euros from a foreign bank by signing an interest-bearing note due April 1, 2021. The dollar value of the loan was as follows:  Angela, Inc., a U.S. company, had a euro receivable from exports to Spain and a British pound payable resulting from imports from England. Angela recorded foreign exchange gain related to both its euro receivable and pound payable. Did the foreign currencies increase or decrease in dollar value from the date of the transaction to the settlement date?

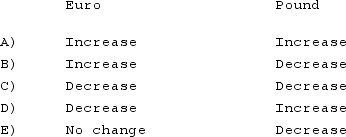

Angela, Inc., a U.S. company, had a euro receivable from exports to Spain and a British pound payable resulting from imports from England. Angela recorded foreign exchange gain related to both its euro receivable and pound payable. Did the foreign currencies increase or decrease in dollar value from the date of the transaction to the settlement date?

A) Option A.

B) Option B.

C) Option C.

D) Option D.

E) Option E.

Correct Answer:

Verified

Q17: Clark Stone purchases raw material from its

Q18: Jackson Corp. (a U.S.-based company) sold parts

Q19: Schrute Inc. had a receivable from a

Q20: Curtis purchased inventory on December 1, 2020.

Q21: On December 1, 2021, Keenan Company, a

Q23: A forward contract may be used for

Q24: On December 1, 2021, Keenan Company, a

Q25: All of the following data may be

Q26: On December 1, 2021, Keenan Company, a

Q27: U.S. GAAP provides guidance for hedges of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents