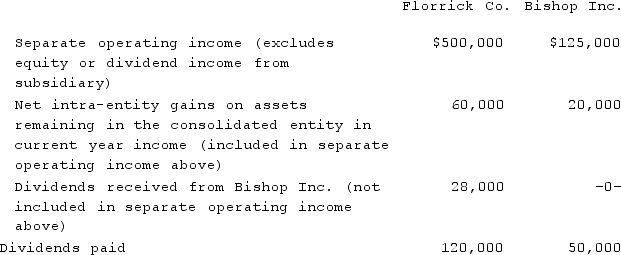

Florrick Co. owns 85% of Bishop Inc. The two companies file a consolidated income tax return and Florrick uses the initial value method to account for the investment. The following information is available from the two companies' financial statements:  The income tax rate was 40%.What is the amount of taxable income reported on the consolidated income tax return?

The income tax rate was 40%.What is the amount of taxable income reported on the consolidated income tax return?

A) $565,000.

B) $605,000.

C) $531,250.

D) $625,000.

E) $545,000.

Correct Answer:

Verified

Q6: Evanston Co. owned 60% of Montgomery Corp.

Q7: Florrick Co. owns 85% of Bishop Inc.

Q8: Florrick Co. owns 85% of Bishop Inc.

Q9: Florrick Co. owns 85% of Bishop Inc.

Q10: In a tax-free business combination,

A) The income

Q12: Beagle Co. owned 80% of Maroon Corp.

Q13: Chapman Co. acquired all of Klein Co.

Q14: Gardner Corp. owns 80% of the voting

Q15: Riley Corp. owned 90% of Brady Inc.,

Q16: Gardner Corp. owns 80% of the voting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents