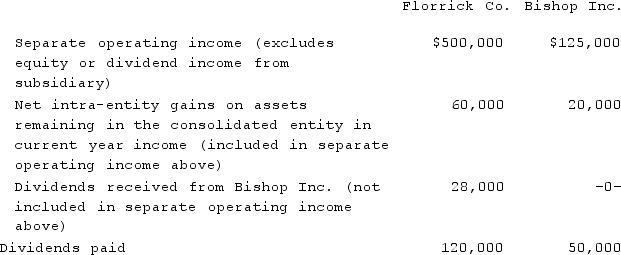

Florrick Co. owns 85% of Bishop Inc. The two companies file a consolidated income tax return and Florrick uses the initial value method to account for the investment. The following information is available from the two companies' financial statements:  The income tax rate was 40%.What was the net income attributable to the noncontrolling interest, assuming that the separate return method was used to assign the income tax expense?

The income tax rate was 40%.What was the net income attributable to the noncontrolling interest, assuming that the separate return method was used to assign the income tax expense?

A) $12,625

B) $12,280

C) $31,250

D) $10,575

E) $6,750

Correct Answer:

Verified

Q4: Gardner Corp. owns 80% of the voting

Q5: Beagle Co. owned 80% of Maroon Corp.

Q6: Evanston Co. owned 60% of Montgomery Corp.

Q7: Florrick Co. owns 85% of Bishop Inc.

Q8: Florrick Co. owns 85% of Bishop Inc.

Q10: In a tax-free business combination,

A) The income

Q11: Florrick Co. owns 85% of Bishop Inc.

Q12: Beagle Co. owned 80% of Maroon Corp.

Q13: Chapman Co. acquired all of Klein Co.

Q14: Gardner Corp. owns 80% of the voting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents