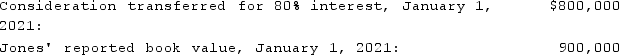

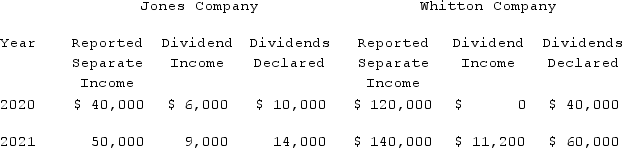

On January 1, 2020, Jones Company bought 15% of Whitton Company. Jones paid $150,000 for these shares, an amount that exactly equaled the proportionate book value of Whitton. On January 1, 2021, Whitton acquired 80% ownership of Jones. The following data are available concerning Whitton's acquisition of Jones:  Excess fair value over book value (assigned to trademarks) is amortized over 20 years. The initial value method is used by both companies. The following information is available regarding Jones and Whitton:

Excess fair value over book value (assigned to trademarks) is amortized over 20 years. The initial value method is used by both companies. The following information is available regarding Jones and Whitton:  Compute Whitton's accrual-based consolidated net income for 2021.

Compute Whitton's accrual-based consolidated net income for 2021.

A) $199,000.

B) $190,000.

C) $185,000.

D) $184,000.

E) $176,000.

Correct Answer:

Verified

Q30: Which of the following statements is true

Q31: The benefits of filing a consolidated tax

Q32: Chase Company owns 80% of Lawrence Company

Q33: Hardford Corp. held 80% of Inglestone Inc.,

Q34: Which of the following statements is false

Q36: Chase Company owns 80% of Lawrence Company

Q37: Chase Company owns 80% of Lawrence Company

Q38: On January 1, 2020, Jones Company bought

Q39: Which of the following statements is false

Q40: On January 1, 2020, Jones Company bought

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents