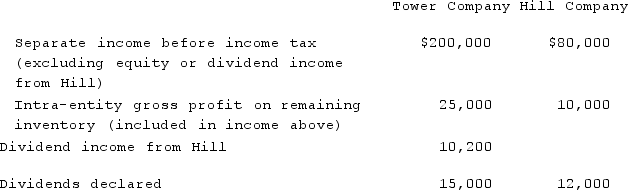

Tower Company owns 85% of Hill Company. The two companies engaged in several intra-entity transactions. There were no excess fair-value amortization amounts to account for. Each company's income before income tax and dividend income for the current time period follow, as well as the effects of intra-entity gross profits on remaining inventory which are included in the separate net income amounts. No income tax accruals have been recognized within these totals. The tax rate for each company is 30%.  What is the income tax liability for the current year if consolidated tax returns are prepared?

What is the income tax liability for the current year if consolidated tax returns are prepared?

A) $55,560.

B) $70,350.

C) $60,000.

D) $73,500.

E) $84,000.

Correct Answer:

Verified

Q55: In a father-son-grandson combination, which of the

Q56: On January 1, 2021, a subsidiary buys

Q57: Tower Company owns 85% of Hill Company.

Q58: How is goodwill amortized?

A) It is not

Q59: Woods Company has one depreciable asset valued

Q61: Delta Corporation owns 90% of Sigma Company,

Q62: Alpha Corporation owns 100% of Beta Company,

Q63: Paris, Inc. owns 80% of the voting

Q64: Alpha Corporation owns 100% of Beta Company,

Q65: Delta Corporation owns 90% of Sigma Company,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents