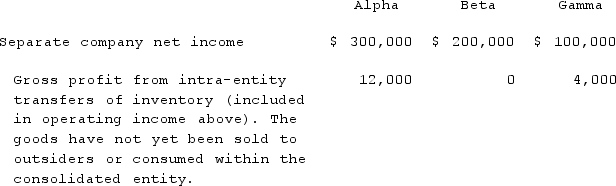

Alpha Corporation owns 100% of Beta Company, and Beta owns 80% of Gamma, Inc., all of which are domestic corporations. There were no excess allocation values at the date of acquisition of the subsidiaries. Information for the three companies for the year ending December 31, 2021 follows:  Which of the following statements is true?

Which of the following statements is true?

A) Alpha and Beta must file a consolidated income tax return, but must exclude Gamma from the consolidated return.

B) Alpha, Beta, and Gamma must file a consolidated income tax return.

C) Alpha, Beta, and Gamma must file separate income tax returns because the ownership of Beta is less than 100%.

D) Alpha, Beta, and Gamma will probably not file a consolidated income tax return.

E) Alpha, Beta, and Gamma may file separate income tax returns or a consolidated income tax return.

Correct Answer:

Verified

Q64: Alpha Corporation owns 100% of Beta Company,

Q65: Delta Corporation owns 90% of Sigma Company,

Q66: Alpha Corporation owns 100% of Beta Company,

Q67: Paris, Inc. owns 80% of the voting

Q68: Pear, Inc. owns 80% of Apple Corporation.

Q70: Dean, Inc. owns 90% of Ralph, Inc.

Q71: Alpha Corporation owns 100% of Beta Company,

Q72: Delta Corporation owns 90% of Sigma Company,

Q73: Paris, Inc. owns 80% of the voting

Q74: Alpha Corporation owns 100% of Beta Company,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents