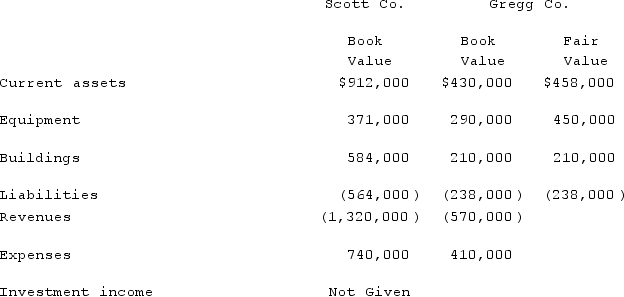

Scott Co. acquired 70% of Gregg Co. for $525,000 on December 31, 2019 when Gregg's book value was $580,000. The Gregg stock was not actively traded. On the date of acquisition, Gregg had equipment (with a ten-year life) that was undervalued in the financial records by $170,000. One year later, the two companies provided the selected amounts shown below. Additionally, no dividends have been paid.  What is the noncontrolling interest's share of the subsidiary's net income for the year ended December 31, 2020 and what is the ending balance of the noncontrolling interest in the subsidiary at December 31, 2020?

What is the noncontrolling interest's share of the subsidiary's net income for the year ended December 31, 2020 and what is the ending balance of the noncontrolling interest in the subsidiary at December 31, 2020?

A) $48,000 and $262,800.

B) $48,000 and $273,000.

C) $42,900 and $267,900.

D) $42,900 and $262,800.

E) $48,000 and $267,900.

Correct Answer:

Verified

Q35: When consolidating a subsidiary that was acquired

Q36: Jax Company used the acquisition method when

Q37: Scott Co. acquired 70% of Gregg Co.

Q38: All of the following statements regarding the

Q39: On January 1, 2019, Palk Corp. and

Q41: Pell Company acquires 80% of Demers Company

Q42: Pell Company acquires 80% of Demers Company

Q43: McGuire Company acquired 90 percent of Hogan

Q44: McGuire Company acquired 90 percent of Hogan

Q45: McGuire Company acquired 90 percent of Hogan

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents