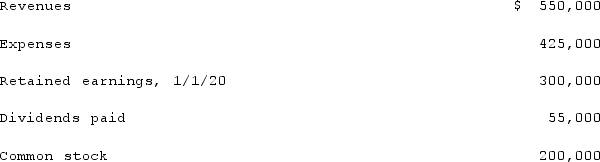

Brady, Inc., a calendar-year corporation, acquires 85% of Austin Company on September 1, 2019, and an additional 10% on January 1, 2020. Total annual amortization of $8,000 relates to the first acquisition. Austin reports the following figures for 2020:  Without regard for this investment, Brady independently earns $375,000 in net income during 2020.All net income is earned evenly throughout the year.What is the controlling interest in consolidated net income for 2020?

Without regard for this investment, Brady independently earns $375,000 in net income during 2020.All net income is earned evenly throughout the year.What is the controlling interest in consolidated net income for 2020?

A) $464,250.

B) $474,450.

C) $481,250.

D) $492,000.

E) $500,000.

Correct Answer:

Verified

Q22: On January 1, 2019, Palk Corp. and

Q23: On January 1, 2019, Palk Corp. and

Q24: When a subsidiary is acquired sometime after

Q25: In a step acquisition, which of the

Q26: In measuring the noncontrolling interest immediately following

Q28: When a parent uses the equity method

Q29: Scott Co. acquired 70% of Gregg Co.

Q30: When a parent uses the partial equity

Q31: Which of the following statements is true

Q32: When a parent uses the initial value

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents