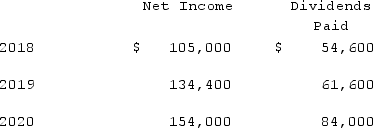

On January 1, 2018, Vacker Co. acquired 70% of Carper Inc. by paying $650,000. This included a $20,000 control premium. Carper reported common stock on that date of $420,000 with retained earnings of $252,000. A building was undervalued in the company's financial records by $28,000. This building had a ten-year remaining life. Copyrights of $80,000 were to be recognized and amortized over 20 years.Carper earned income and paid cash dividends as follows:  On December 31, 2020, Vacker owed $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition.Required:If the equity method had been applied by Vacker for this acquisition, what were the consolidation entries needed as of December 31, 2020?

On December 31, 2020, Vacker owed $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition.Required:If the equity method had been applied by Vacker for this acquisition, what were the consolidation entries needed as of December 31, 2020?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q104: Beta Corp. owns less than one hundred

Q105: On January 1, 2020, John Doe Enterprises

Q106: When a parent company acquires a less-than-100

Q107: What is pre-acquisition income?

Q108: Prevatt, Inc. owns 80% of Franklin Company.

Q110: When a parent company acquires a less-than-100

Q111: On January 1, 2020, John Doe Enterprises

Q112: How would you determine the amount of

Q113: Why is it important to know if

Q114: On January 1, 2019, Glenville Co. acquired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents