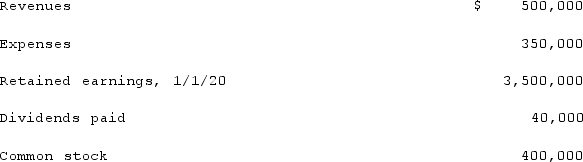

McLaughlin, Inc. acquires 70% of Ellis Corporation on September 1, 2019, and an additional 10 percent on November 1, 2020. Annual amortization of $12,000 relates to the first acquisition. Ellis reports the following figures for 2020:  Without regard for this investment, McLaughlin earns $480,000 in net income ($840,000 revenues less $360,000 expenses; incurred evenly through the year) during 2020.Required:Prepare a schedule of consolidated net income and apportionment to noncontrolling and controlling interests for 2020.

Without regard for this investment, McLaughlin earns $480,000 in net income ($840,000 revenues less $360,000 expenses; incurred evenly through the year) during 2020.Required:Prepare a schedule of consolidated net income and apportionment to noncontrolling and controlling interests for 2020.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q98: Pell Company acquires 80% of Demers Company

Q99: Tosco Co. paid $540,000 for 80% of

Q100: Caldwell Inc. acquired 65% of Club Corp.

Q101: On January 1, 2019, Glenville Co. acquired

Q102: How is a noncontrolling interest in the

Q104: Beta Corp. owns less than one hundred

Q105: On January 1, 2020, John Doe Enterprises

Q106: When a parent company acquires a less-than-100

Q107: What is pre-acquisition income?

Q108: Prevatt, Inc. owns 80% of Franklin Company.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents