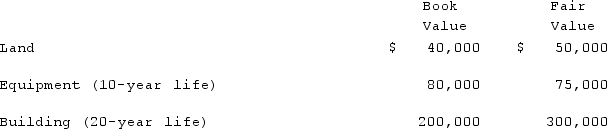

Watkins, Inc. acquires all of the outstanding stock of Glen Corporation on January 1, 2020. At that date, Glen owns only three assets and has no liabilities:  If Watkins pays $300,000 in cash for Glen, at what amount would the subsidiary's Building be represented in a January 2, 2020 consolidation?

If Watkins pays $300,000 in cash for Glen, at what amount would the subsidiary's Building be represented in a January 2, 2020 consolidation?

A) $200,000.

B) $225,000.

C) $273,000.

D) $279,000.

E) $300,000.

Correct Answer:

Verified

Q84: Watkins, Inc. acquires all of the outstanding

Q85: Fesler Inc. acquired all of the outstanding

Q86: Private companies, with respect to goodwill:

A) May

Q87: Fesler Inc. acquired all of the outstanding

Q88: Jaynes Inc. acquired all of Aaron Co.'s

Q90: Fesler Inc. acquired all of the outstanding

Q91: Jaynes Inc. acquired all of Aaron Co.'s

Q92: When is a goodwill impairment loss recognized?

A)

Q93: Hanson Co. acquired all of the common

Q94: With respect to the recognition of goodwill

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents