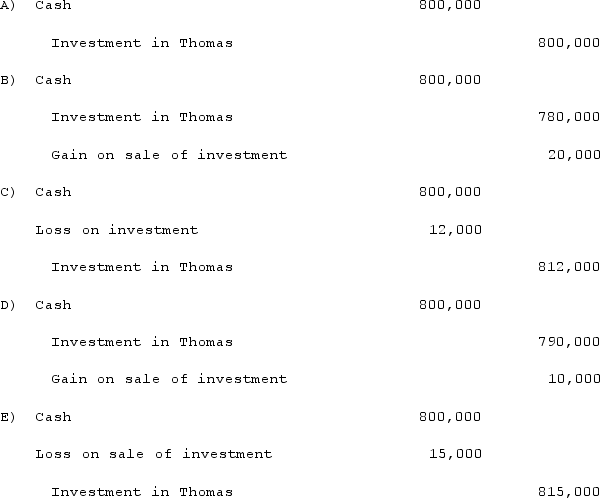

On January 3, 2021, Roberts Company purchased 30% of the 100,000 shares of common stock of Thomas Corporation, paying $1,500,000. There was no goodwill or other cost allocation associated with the investment. Roberts has significant influence over Thomas. During 2021, Thomas reported net income of $300,000 and paid dividends of $100,000. On January 4, 2022, Roberts sold 15,000 shares for $800,000.What is the appropriate journal entry to record the sale of the 15,000 shares?

A) A Above.

B) B Above.

C) C Above.

D) D Above.

E) E Above.

Correct Answer:

Verified

Q38: Jones, Incorporated acquires 15% of Anderson Corporation

Q39: When an investor appropriately applies the equity

Q40: Under the equity method, when the company's

Q41: On January 1, 2020, Mehan, Incorporated purchased

Q42: On January 1, 2021, Anderson Company purchased

Q44: On January 1, 2020, Mehan, Incorporated purchased

Q45: On January 1, 2021, Anderson Company purchased

Q46: On January 4, 2021, Mason Co. purchased

Q47: On January 1, 2020, Mehan, Incorporated purchased

Q48: On January 3, 2020, Baxter, Inc. acquired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents