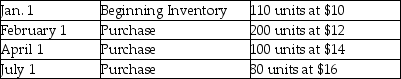

The following data was obtained from the records of Brankovich Tool and Die, Inc., for the current year:

The company sold 200 units during the year. Sales for the year are $70,000; operating expenses are $20,000; and the tax rate is 40%.

The company sold 200 units during the year. Sales for the year are $70,000; operating expenses are $20,000; and the tax rate is 40%.

Required:

Using the multistep format, prepare the income statement using:

1. FIFO

2. LIFO

3. Average cost (Round all calculations to two decimal places.)

Correct Answer:

Verified

(80 × $16)+ ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: Under U.S.GAAP,the application of the lower-of-cost-or-market rule

Q84: A company uses LIFO in one year,then

Q85: Which of the following is a CORRECT

Q86: When applying the lower-of-cost-or-market rule to inventories,

Q87: Uptown Department Store uses the perpetual inventory

Q88: Perfect Catering Company's ending inventory was $109,700

Q91: The units of inventory available for sale

Q92: Under U.S. GAAP, inventories are reported on

Q94: Carboni Company had the following data available

Q100: IFRS defines market value for inventory as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents